EXPANDING THE APPEAL OF LUXURY BRANDS IN CHINA?

In a country that’s flush with luxury brands competing for attention, sustaining a share of mind and revenue growth is a challenge. China’s top luxury brands are pushing the boundaries with daring marketing tactics. They’ve become forerunners in the marketing of luxury, pushing into an array of new, and sometimes surprising areas: livestream shows, tie-ins with rap, street culture, video games, NFTs, and now… wet markets?!?

Was Prada’s wet market takeover linked to a brand strategy? What goals did this serve for the brand? Was it about growth into a new, aspiring buyer group (of vegetable buyers)? Nope. Is Prada trying to build wider consent and recognition as a luxury brand? Maybe. Was it about supporting local culture? Partly (especially as wet markets were maligned during Covid). Odds are that it’s mostly about grabbing attention and winning marks for being “brave.” In a realm where most luxury brands are dull and forgettable, being brave is an important strategy in itself. But the balance between exclusivity and accessibility is fragile. And as many luxury brands have learned the hard way in China, the balance between cultural sensitivity and shock value is also delicate.

The scope of potential buyers for luxury brands can - at times - become too narrow (and as pressure grows to get more from a market), luxury brands must widen the lens and expand the pool of buyers.

Building awareness among mass, non-buyers validates the prestige of ownership (for buyers) …but go too far with mass marketing and the brand looses its mystique.

Luxury brands are best served alternating between periods of exclusivity and accessibility, providing occasional glimpses into brand identity, for the masses..

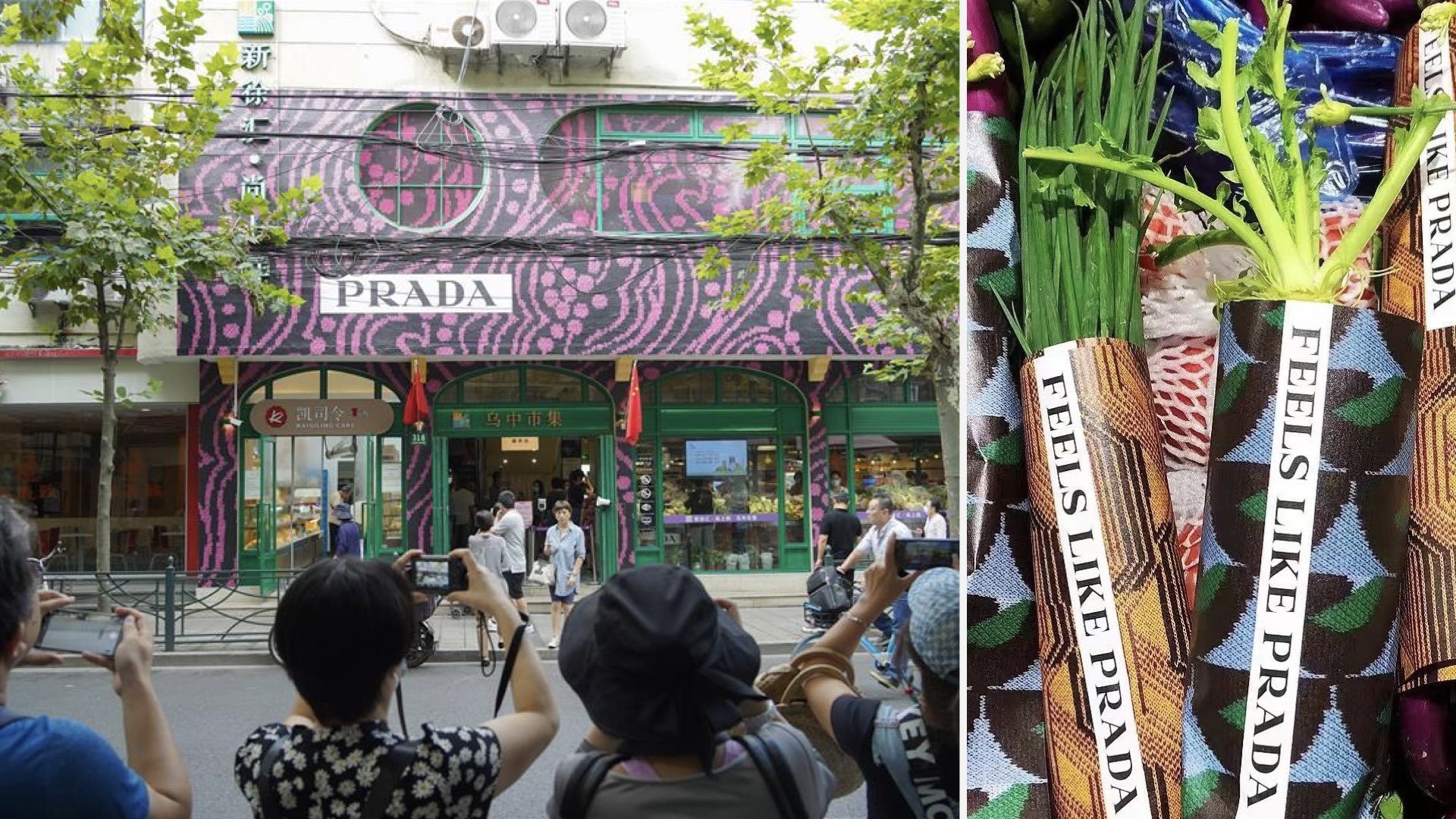

PRADA’S VEGETABLE MARKET TAKEOVER IN SHANGHAI

Over the October holiday, Prada re-branded a neighborhood vegetable market in Shanghai to make it “Feel like Prada.” During a holiday where cosmopolitan Shanghaiers were staying close to home, this counts as a win for awareness and buzz. It attracted a wide mix of visitors for photo opps, from social influencers to grandma’s …with the bulk of visitors showing up to win points on social media …and perhaps score a branded souvenir.

HERMES’ BRANDED GYM IN CHENGDU

Faced with a downturn in many of its traditional product lines (eg. luxury scarves) during Covid, Hermes has made a move into more casual luxury, with a range of fitness inspired products and setup a brand gym pop-up in Chengdu (in May ’21). Its a move that aligns the brand to the massive athleisure trend. Hopes will be that moves like this help the brand become younger, and tap into Millennial and GenZ buyers.